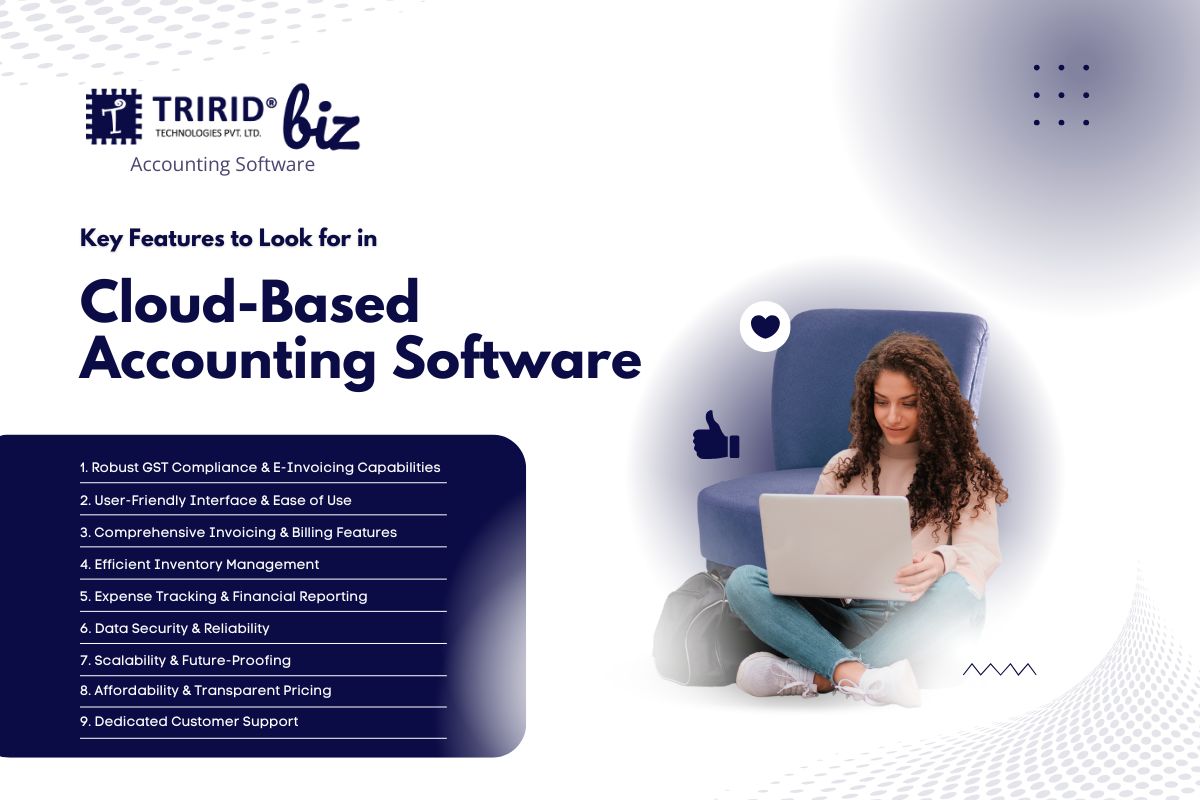

Key Features to Look for in Cloud-Based Accounting Software for Indian SMEs

In the current fast-paced Indian business environment, SMEs are constantly looking for ways to streamline their operations, ensure compliance, and maximize profits. One of the most impactful solutions emerging as a game-changer is cloud-based accounting software. Unlike traditional desktop solutions, cloud accounting offers unparalleled flexibility, accessibility, and real-time insights, becoming an essential tool for modern Indian SMEs.

With a wide array of options in the market, it gets difficult to choose the accounting software that actually fits a business. Tracking expenses isn’t the point; the point is to have a full-fledged solution that facilitates one’s growth.

Following are the basic features that any Indian SME needs to look for in cloud accounting software:

1. Robust GST Compliance & E-Invoicing Capabilities

GST compliance is a non-negotiable for any business in India. Your cloud accounting software should be equipped with all of the abilities required and related to GST right from invoice generation to filing of returns.

- Key Aspects: Auto-calculation of GST (CGST, SGST, IGST), support for all GST rates, correct handling of HSN/SAC codes, generation of GSTR-1, GSTR-3B, and GSTR-9, and other appropriate reports.

- E-Invoicing: Amidst the government’s push for e-invoicing, check that your software can trigger IRN generation and QR code upload from IRP either directly or via an authorized GSP. This alone can save many hours of work and help stay clear of penalties.

2. User-Friendly Interface & Ease of Use

You’re a business owner, not necessarily an accountant. The best accounting software for small business in India should be intuitive, requiring minimal training to get started.

- Key Aspects: A clean, uncluttered dashboard providing an overview of your finances, easy navigation, simple data entry forms, and clear reporting. Look for drag-and-drop functionalities and automated workflows that reduce manual effort.

- Accessibility: As it’s cloud-based, check for mobile app availability (Android & iOS) to manage finances on the go, from any device.

3. Comprehensive Invoicing & Billing Features

Efficient billing is the backbone of any business. Your software should not just generate invoices but also manage the entire billing lifecycle.

- Key Aspects: Professional invoice templates with your brand’s logo, recurring invoice options for subscription-based services, proforma invoices, credit/debit notes, and automated payment reminders.

- Quotation to Invoice: The ability to convert quotes directly into invoices with a single click streamlines your sales process and minimizes errors.

4. Efficient Inventory Management

For retail, trading, and manufacturing SMEs, integrated inventory management is critical. It helps prevent stockouts, reduces wastage, and provides real-time stock visibility.

- Key Aspects: Tracking stock levels, managing multiple warehouses (if applicable), tracking batch numbers/serial numbers, automated stock valuation, and alerts for low stock.

- Integrated Solutions: Ideally, your billing software in India should seamlessly integrate inventory data with your sales and purchase records for a holistic view.

5. Expense Tracking & Financial Reporting

Understanding where your money goes is as important as knowing where it comes from.

- Key Aspects: Easy expense recording and categorization, attachment of receipts, bank reconciliation features (auto-matching transactions from your bank feed), and the ability to generate essential financial reports like Profit & Loss statements, Balance Sheets, and Cash Flow statements.

- Customizable Reports: Look for options to customize reports to gain deeper insights into specific aspects of your business.

6. Data Security & Reliability

Concern for data security arises while moving one’s financial data to the cloud. Ensure that your selected vendor puts a premium on the safety and integrity of your critical information.

- Key aspects: SSL encryption, regular backups (along with transparent information about storage), multi-factor authentication (MFA), and compliance with data privacy laws.

- Uptime guarantee: A trustworthy cloud provider always backs an extremely high uptime guarantee, which essentially means the data is accessible to you anytime when required.

7. Scalability & Future-Proofing

Your business will grow, and your software should grow with it.

- Key Aspects: The ability to add more users, manage increased transaction volumes, introduce new features or modules (e.g., payroll, CRM integration) as your business expands without needing to switch software.

- Regular Updates: A good cloud accounting solution will provide automatic, regular updates with new features and compliance changes at no extra cost, keeping your business future-ready.

8. Affordability & Transparent Pricing

Cost is a major consideration for Indian SMEs. While “free GST billing software” might sound tempting, ensure it meets all your functional and compliance needs.

- Key Aspects: Clear pricing plans with no hidden fees, flexible subscription models (monthly/annual), and options that match your budget without compromising on essential features. Consider the long-term value over just the initial price.

9. Dedicated Customer Support

Even the most user-friendly software requires support at times. Especially in India, local support can be invaluable.

- Key Aspects: Multiple support channels (phone, email, chat), quick response times, comprehensive knowledge bases, and user communities. Look for providers that understand the nuances of Indian business practices.

Conclusion: Empower Your SME with the Right Cloud Accounting Software

Picking the appropriate cloud-based accounting software for your Indian SME is a strategic choice affecting your efficiency, compliance, and growth. Prioritizing features such as solid GST functionality, user-friendly interfaces, billing, and inventory management, and security will result in the perfect software solution that acts as the backbone of your business.

Change how you do your accounting and billing. Find a platform built for Indian small businesses!